{Doing the Goals} 2022 Money Planner

As I was reviewing our financial situation and looking ahead to what is coming up (huge tax bill, a son’s wedding, emergency fund replenished after our roof replacement) I knew I needed to get back to being as intentional as we were in 2009 when we started our Total Money Makeover with Dave Ramsey. So I began looking around for some ideas that might help make it a little more fun and a lot more intentional and came across The Passionate Penny Pincher and their new Money Planner.

I reached out to them and they graciously provided me with a planner to review for you this year. I’m not an affiliate and I don’t get anything from this, other than showing you how I use it (and hopefully meeting my financial goals this year). It comes well packaged in a fun box that opens up to reveal durable cash envelopes and the planner.

It’s a nice planner, but the content is what I was most interested in. I need something that will help me meet some pretty serious financial goals this year.

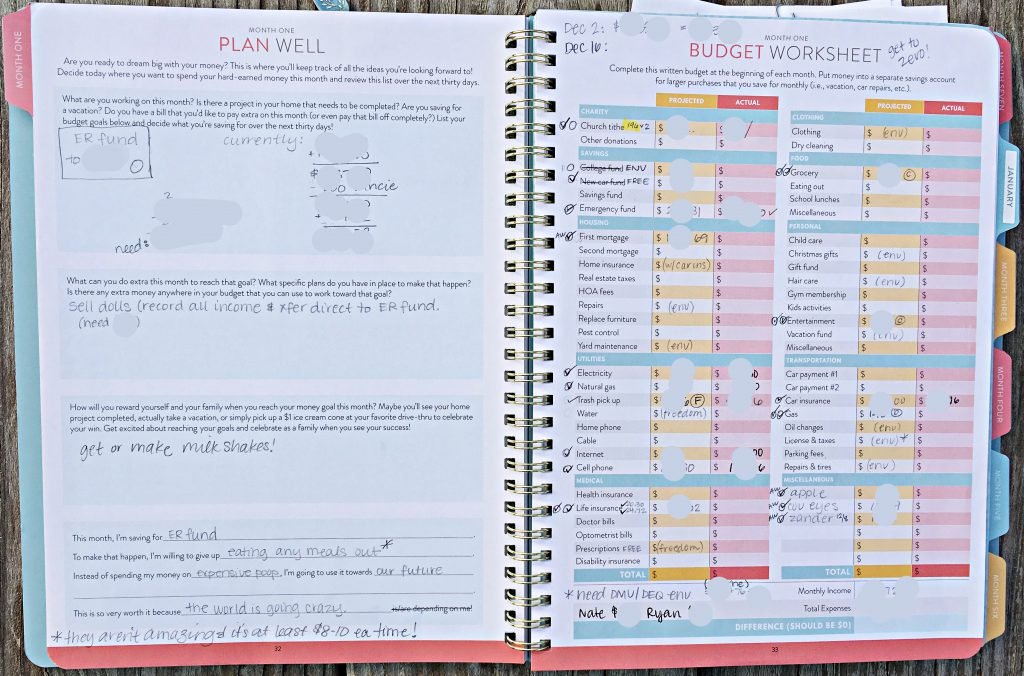

I used it for my practice month of December and officially started for January this month. It has some great introduction pages to help you plan your financial goals, some of which include a bill payment schedule, a bill calendar, and debt reduction plan. Then you get to the monthly set up pages.

Like Dave Ramsey taught me, spend every dollar on paper first. This planner has pages each month to plan that month’s budget along with a different financial challenge for each month, plus a monthly review.

But the important question, will it work? Will it help keep me on track? December was practice month and I got into the swing of things. I’ll update you on financial goals at the end of January. Here are our big financial goals this year:

FINANCIAL

- Rebuild our emergency fund

- Pay off 2020 taxes

- Give $1,000 to son for wedding expenses

- Save monthly for 2021 taxes

- Use the Money Planner each month (checking in with it each week)

- Fill the cash envelopes every month

It’s going to be a push, and just looking at that list makes me stress out a bit, but we’re decluttering, selling everything we can, and being way more intentional about not eating out, or getting coffee out, or buying whatever seems to be an urgent need on Amazon, and, worst of all, we’re not buying books (which is so very sad).